Managing in turbulent times is a tough job.

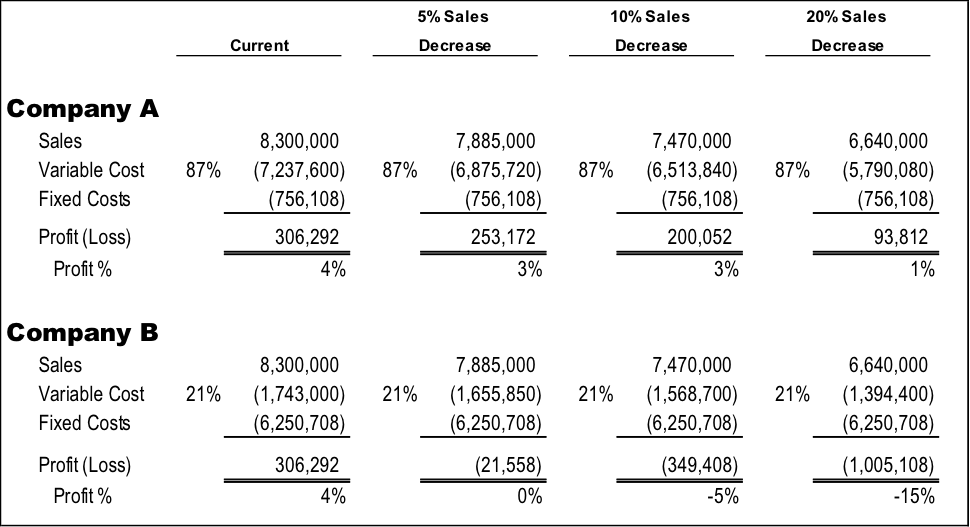

Two companies (detailed below) start out at the same sales and profit levels. Each has a 20% reductions in sales. One company remains profitable. The other company is in serious financial trouble, losing over a million dollars for the year.

Turbulent times offer significant opportunities for business growth and the creation of wealth. However, you need to learn the new skills and the mental mindset required to prosper and grow in a fast-changing environment.

There are a lot of shortcuts you can take in good times and not have major catastrophic results. In the turbulent times we are in now, taking your eye off the ball, even for a short time, could cost you your business life. The risk is too great.

Those who survive and prosper in this mess will be focused on a disciplined monitoring of their critical numbers combined with a focus on building a strong, profitable and growing customer base.

EMBRACE DISCIPLINED MONITORING OF YOUR CRITICAL NUMBERS

Identify Your Strategic and Non-Strategic Costs

Two Fundamental Types of Costs

Each type of cost has a particular purpose and a particular accountability to the business. The goal of strategic costs is to improve sales and improve profitability. The goal of non-strategic costs is to keep these costs to a minimum, while still getting the job done.

Strategic Costs are all the expenditures that you invest to build sales, profits and long-term customer satisfaction (salespeople, advertising, innovations, R&D, etc.). They are the costs that clearly “bring in business.” Cost of innovation that impacts the customer is a strategic cost. (See UPDATE below for more information.)

Non-Strategic Costs are all of the other costs necessary to run the business, but which don’t clearly bring in more business. They get the “work of the business” done as efficiently as possible, at the lowest cost. Administrative costs of all kinds fall in this category: managers, clerical support, rent or real estate cost, consultants, lawyers, accountants, computers, office supplies, etc. Often, this category also includes the support departments.

This allocation requires a great deal of thought and soul searching. There are no easy answers here. These decisions are the most fundamentally important part of your business strategy.

Peter Drucker’s famous observation:

“Because the purpose of business is to create a customer, the business enterprise has two–and only two–basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs. Marketing is the distinguishing, unique function of the business.”

Your role, as leader in turbulent times, is to ensure that:

- You maximize the profit leverage for each dollar spent for marketing and innovation costs. You out-spend your competition for these Strategic Costs, and you do that when times are good and when times are challenging.

- You constantly review the Non-Strategic Costs to eliminate any fat. Cut these costs to the bone.

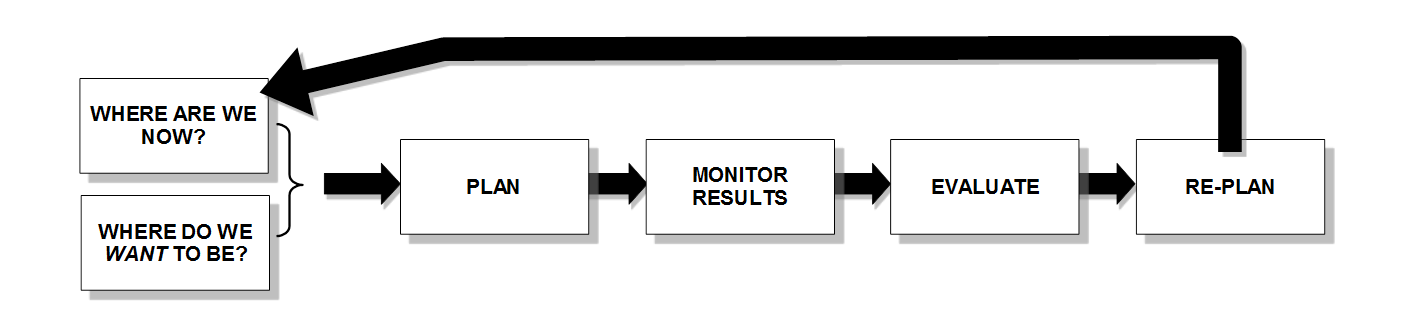

- Review your Critical Numbers daily and weekly. Make the changes in your cost structure that will keep your operations profitable and your business sound. THIS IS NO TIME TO BE IN A STATE OF DENIAL!

Have An Intimate Understanding Of The Relationships In Your Current Business Operating Structure

Each business is different. The cost – sales volume – profit relationship of each is also different. You need to know how the unique interrelationship works between:

- Fixed Costs

- Variable Costs

- Sales Volume

- Mixed Costs (Step Variable)

- Profit Levels

Here are just a few questions you might want to address:

- If sales go up or down by 5%, what happens to your bottom line?

- What happens at 10% or 15% up or down?

- At what sales level do you break-even?

- What cost changes will directly impact your bottom line and which will have little or no effect?

- What changes in cost, volume and profit margins need to take place to break-even?

Here is a sample of two companies who start out at the same sales and profit levels. As sales decrease from 5% to 20% the impact on the bottom line is dramatically different.

Even though sales and profits started at the same level, just a 5% reduction in sales puts Company B in a loss situation, whereas Company A is still quite profitable.

At a 20% sales decrease, the impact on Company B could be devastating. Again, Company A remains profitable.

Many companies wait until they can’t make payroll to figure this out!

You MUST know, right now:

- Your overall cost structure and what will happen to profit levels as sales go down or go up. Start planning now for changes that are likely to happen if, or when, sales do slide.

- Your Strategic and Non-Strategic cost structure and what changes you will make if, or when, sales begin to slide.

- Your Critical Numbers for the Company overall and for each individual employee.

NURTURE AND BUILD YOUR CUSTOMER BASE

Now is the time to focus on the relationships with your current customers by-

- Creating more value for customers

- Increasing the frequency of sale from current customers

- Increasing the size of each sale from current customers

- Increasing the word-of-mouth (referral) business

- Reducing the number of customers who stop doing business with you

- Getting lost customers to come back and buy from you.

- Attracting additional customers in the current market niche

- Attracting customers from new market niches.

Remember, managing in turbulent times is tough. Turbulent times also offer tremendous opportunities for business wealth creation. But only for those who learn the new skills and mental mindset required to lead in a hyper-changing environment.

RESOURCES:

You will probably hate the title of this book, but it has a ton of good ideas in it–especially chapters 27 and 43 on measurement and managing by the right numbers. No B.S. Ruthless Management of People and Profits (Paperback) by Dan S. Kennedy

Woods & Company Report: The 9 Steps to Build Profits in Challenging Business Times…Make more money from your existing customer base. Great ideas from the experts – Success leaves clues – You don’t have to reinvent the wheel.

Website: The Accounting Coach. It has some basic managerial accounting information. Business owners should review the “managerial” section for topics such as: break-even, activity based accounting, improving profits, ratio analysis, etc.

I have not read this book yet. People I trust have recommended it. Difference: The one-page method for reimagining your business and reinventing your marketing (Paperback) by Bernadette Jiwa

More Detail On Strategic Costs

Strategic Costs are the Sales and Profit Builder…

Not all costs are created equally. Some costs (marketing, sales and innovation costs) build the business – they improve sales, profits. customer satisfaction and long-term customer retention. The objective of a strategic cost is to-

- Get new customers in the door

- Get existing customers in the door

- Get ex-customers back in the door

- Get new customers in the door who are outside of your current target/traditional market

- Get customers to buy more often

- Get customers to buy in higher quantities

- Get customers to take advantage of your premium products and services

- Get customers to refer their friends and relatives to do business with you.

- Encourage your strategic partners to send you more business

- Encourage competitors to refer business to you (Surprised? This can be a valuable source of business!)

- Get better sales execution through effective sales training

- Produce effective advertising (that gets results)

- Improve display and lighting methods that promote higher sales or require less salesperson involvement

- Improve ordering system to make it easier for customers to buy or to buy more

- Activate customer innovation activities (large and small) that improve the Company <–> Customer relationship

Every dollar of wasted strategic cost is potentially $10, $20, $200 or more, of lost revenue. Strategic costs must be accountable, because the downside can be huge.